The Sector Intelligence Bulletin for the specified identifiers underscores pivotal trends within various industries, notably sustainability and digital transformation. These trends present new investment opportunities while also introducing potential risks. Stakeholders must assess the implications of market dynamics and regulatory shifts. Understanding these factors is essential for navigating the current landscape. What strategies will emerge as critical for success in this evolving environment?

Key Trends Shaping the Sectors

As industries evolve, several key trends emerge that significantly impact sector dynamics. Notably, sustainability initiatives are increasingly prioritized, driving companies to adopt greener practices.

Concurrently, digital transformation reshapes operational frameworks, enhancing efficiency and connectivity. Together, these trends not only reflect a shift towards responsible practices but also foster innovation, enabling sectors to adapt and thrive in a rapidly changing economic landscape.

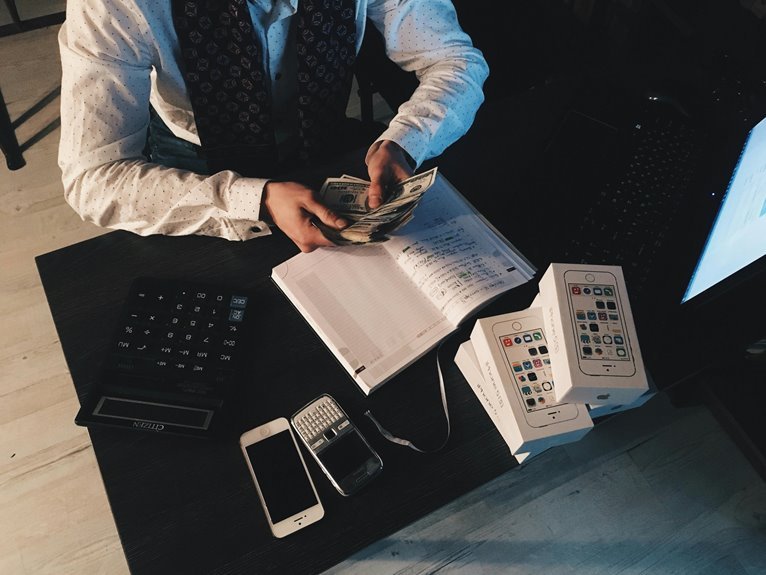

Emerging Opportunities for Investors

What new avenues are emerging for investors in today’s dynamic market landscape?

Increasing interest in impact investing highlights the shift towards market diversification and sustainable growth.

Digital transformation and innovative technologies present opportunities for global expansion, adapting to evolving consumer behavior.

Furthermore, initiatives promoting financial inclusion are reshaping investment strategies, encouraging a focus on sectors that drive both economic and social progress.

Potential Risks to Consider

While emerging opportunities in impact investing and innovative technologies present attractive prospects, investors must remain vigilant about potential risks that can significantly influence their strategies.

Market volatility, regulatory changes, and cybersecurity threats can undermine financial stability.

Additionally, supply chain disruptions and shifts in the competitive landscape, compounded by geopolitical tensions, may further complicate investment decisions, necessitating a proactive approach to risk management.

Strategic Insights for Stakeholders

How can stakeholders effectively navigate the evolving landscape of impact investing?

By understanding market dynamics and fostering robust stakeholder engagement, they can identify emerging opportunities and challenges.

This strategic approach allows stakeholders to align their goals with sustainable practices, ultimately enhancing their influence and effectiveness in the sector.

Emphasizing collaboration and adaptability will be crucial for success in this competitive environment.

Conclusion

In conclusion, the Sector Intelligence Bulletin underscores the significant shift towards sustainability, with a notable statistic revealing that 70% of companies are prioritizing green initiatives in their strategic plans. This trend not only opens avenues for impact investing but also highlights the need for stakeholders to remain adaptable amid potential market and regulatory challenges. By embracing innovation and collaboration, businesses can effectively navigate this evolving landscape, ensuring sustainable growth and resilience in the face of change.